Most organizations tend to pay suppliers anywhere from 30, 60 to 90 days out as part of a deliberate effort to hold on to cash for as long as possible. But now suppliers are starting to provide customers with discounts for paying bills early. The trouble is that most of the accounts payable systems used to keep track of invoices are not especially efficient, which often results in an opportunity to reduce costs being lost. It’s not uncommon for organizations these days to receive significant additional discounts on their total spend by paying invoices early.

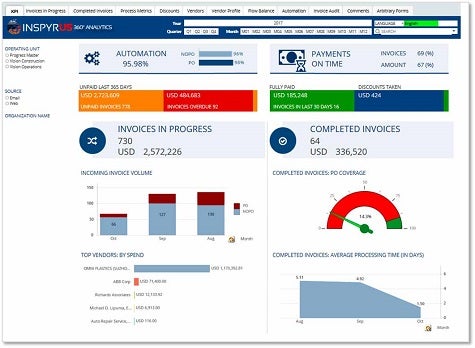

To make it simpler for organizations to manage their invoices, Inspyrus created an Inspyrus C3 software-as-a-service (SaaS) application that integrates processes spanning ERP and finance applications from Oracle, IBM and SAP to automate the processing of invoices in real time.

Chris Preston, executive vice president of Inspyrus, says when it comes to accounts payable, most organizations today have not progressed much past employing email to transfer electronic documents that are scanned into ERP systems using optical character recognition (OCR) software. Essentially, they are replicating a paper-based process in email, says Preston.

“When you think about it, email has become the new paper,” says Preston.

Inspyrus is making the case for an application for processing invoices in real time that not only reduces overhead, but just as importantly provides more visibility and insight into the processing of invoices, says Preston.

When it comes to financial technology, there’s obviously a lot of excitement these days about all things relating to the potential of artificial intelligence (AI). But for all the potential of AI, sometimes the payback associated with automating something as simple as the processing of invoices can deliver a much bigger and more immediate bang on investment.