The opportunity to transform banking by relying more on digital processes is starting to attract some new players. Kony, Inc., a provider of web and mobile application development tools, has launched Kony DBX, a platform for both building applications and deploying a suite of retail banking applications.

Jeffery Kendall, senior vice president for banking at Kony, says Kony DBX provides an alternative to packaged applications that are widely used by retail banks and credit unions that have failed to keep pace with innovations such as mobile deposits. As a result, banks that have developed their own applications have a decided edge over banks that continue to depend solely on outdated packaged applications, says Kendall.

“They have not been able to keep up in terms of the customer experience provided,” says Kendall.

The core Kony DBX platform comes with 200 built-in compliance and security features, including white-box cryptography, advanced authentication, and one-click binary protection. Other features include transfers, peer-to-peer (P2P) payments, and mobile deposits as well as integration with emerging technologies such as chatbots, blockchain, artificial intelligence (AI) and augmented reality (AR), says Kendall.

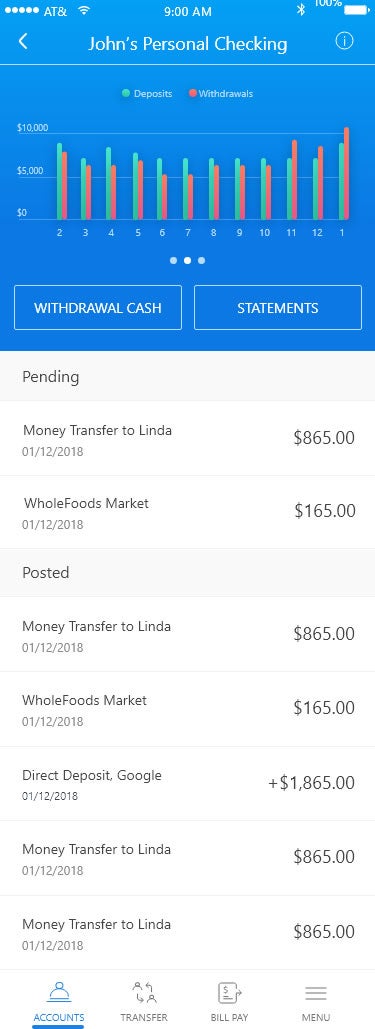

The Kony DBX Retail Banking application, meanwhile, offers a more turnkey approach to over 125 features and functions.

Regardless of the approach taken, it’s clear that customers are losing patience with banks that are unable to fully exploit mobile computing devices, which in turn is creating opportunities for potential rivals that include PayPal and Apple. The issue now is to what degree providers of legacy banking applications will be able to respond before the banks they serve are forced by their customers to move into the digital age without them.