SAP has always been a leading provider of CRM software. However, SAP’s strategy has shifted toward a software-as-a-service (SaaS) model through which it plans to close the gap between its offerings and Salesforce. That effort is manifesting itself in the form of SAP Sales Cloud, an instance of a CRM application that combines elements of various SAP acquisitions to create a CRM application optimized to run on the SAP HANA in-memory database.

Offered as part of a C/4 suite of customers experience applications, SAP views CRM as one element of an integrated approach to driving digital business transformation spanning multiple classes of enterprise applications, including its suite of S/4 ERP applications.

Previously, SAP had only offered an instance of CRM software based on Java that required an instance of SAP Netweaver middleware to achieve any level of integration. It’s not clear what percentage of the existing SAP base of CRM customers are making the move SAP Sales Cloud. It is clear, however, that SAP has lost ground in terms of market share as adoption of CRM solutions continues to grow.

Salesforce, meanwhile, continues to see it share of the CRM market grow. Much like SAP, Salesforce is now focusing its efforts on enabling customers to deliver a unified customer experience. To achieve that goal Salesforce has acquired a range of complementary applications and middleware offerings, all of which are in various stages of being more tightly integrated with its core CRM software.

What are the Similarities & Differences between Salesforce and SAP Sales Cloud?

Salesforce clearly still view sales teams at the center of the business universe, so it should not come as a surprise that there are more features and capabilities in its core CRM offering. Less clear is to what degree any sales team is going to use any set of application features. Regardless of the application category, most users only wind up regularly employing about 10 to 20 percent of the capabilities in that application. However, in terms of empowering salespeople, there’s a reason why so many sales teams have standardized on Salesforce.

SAP Sales Cloud has all the standard CRM features most organizations are going to require. However, SAP Sales Cloud in comparison to Salesforce is not quite as mature a SaaS offering. SAP has been playing catchup with Salesforce in this area, which first involved acquiring Hybris, then reworking the Hybris application portfolio to run on the SAP HANA database, and then launching a SaaS application.

There are a handful capabilities that SAP Sales Cloud can handle better, such as configure, price and quote (CPQ) functions. For the most part, however, SAP Sales Cloud has a way to go before it becomes as comprehensive as Salesforce. Arguably, the most attractive thing about SAP Sales Cloud is its potential to be integrated with the rest of SAP ERP application portfolio that also runs on the SAP HANA in-memory computing database. SAP is making a case for a broad shift to near real-time computing enabled by the SAP in-memory computing database. The degree to which those real-time capabilities are relevant in terms of driving a CRM application have yet to be conclusively shown. But the idea is that changes to the availability of a product in a supply chain application would automatically manifest themselves in SAP Sales Cloud.

In contrast, Salesforce needs to rely on third-party partners such a FinancialForce.com to achieve a similar application experience using the same underlying database and customer records. Much of this SAP effort in this regard, however, remains a work in progress and there are many organizations that have already chosen to integrate their Salesforce CRM applications with SAP ERP applications that run mainly in on-premise IT environments.

| Criteria | SAP Sales Cloud | Salesforce |

| Cost | Starts at $57 per user per month for an annual subscription | Starts at $25 per user per month for an annual subscription |

| Ease of Use (10%) |

4 |

5 |

| Implementation (20%) |

4 |

4 |

| Customization (20%) |

3 |

5 |

| Integrations (20%) |

4 |

5 |

| Customer Support (15%) |

4 |

5 |

| Features & Add-ons (15%) |

3 |

5 |

| Total Rating |

3.7 |

4.8 |

*Where applicable, include screenshots of product interfaces, and comparison charts/graphs throughout the following sub topics.

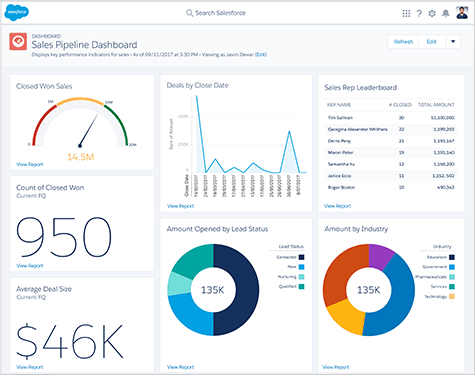

Salesforce User Experience Screenshot

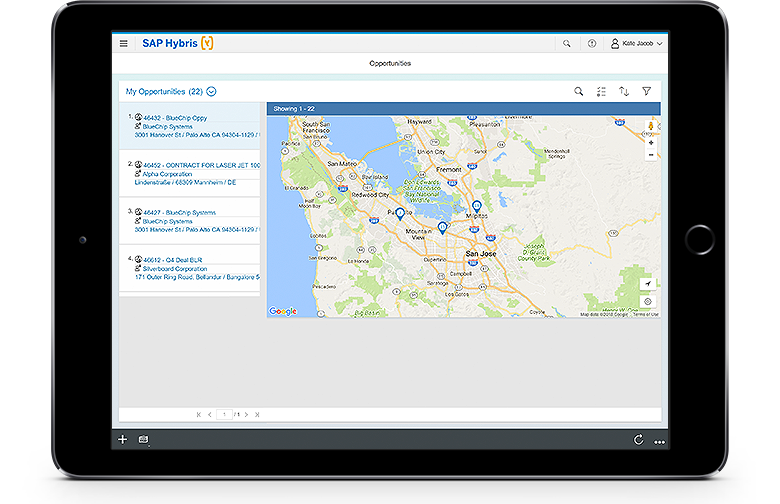

SAP SalesCloud User Experience Screenshot

Cost

Salesforce starts at a cost of $25 per user per month that can easily rise as more capabilities are invoked. Salesforce has also built a reputation for not being willing to negotiate on pricing.

SAP on its app store publishes an entry list price of $57 per user per month for an annual contract. In many instances, however, customers that have already embraced SAP ERP application software should expect SAP to be aggressive in terms of its willingness to either keep Salesforce out of its account base, or whenever possible supplant Salesforce.

As is often the case with enterprise software, the total cost of an application is going to vary substantially once all the modules counted, the numbers of users per month is tabulated, and, of course, just how tough a negotiator any customer can be. Savvy IT organizations always make sure they have plenty of paraphernalia from rival vendors in plain sight whenever an IT salesperson pays them a visit.

Ease of Use

Salesforce has spent years optimizing the user experience across multiple platforms. The Salesforce CRM application presents a clean user interface that is easily accessible from any desktop or mobile computing device. Salesforce in recent releases has been steadily improving the workflow capabilities built into its core platform.

SAP like Salesforce now likes to tout the fact that SAP Sales Cloud is one of the first applications the company has developed with a mobile-first philosophy. The effort represents substantial progress for SAP, but that application experience is not as uniform across as many applications as it is on the Salesforce platform.

It’s also worth noting that both companies are taking divergent paths to injecting artificial intelligence (AI) into their various application portfolios. Salesforce relies on an Einstein framework to automate various mundane tasks.

SAP has yet to manifest any major AI capabilities specifically in SAP Sales Cloud. However, SAP is infusing its underlying SAP HANA database on which SAP Sales Cloud is built with machine learning algorithms to automate a wide range of tasks across its entire application portfolio. However, in terms of making those capabilities available within the context of a CRM application, SAP clearly lags Salesforce.

Implementation

Salesforce is widely credited with being an early pioneer of software-as-a-service (SaaS) applications and has remained irresolutely committed to that cloud-based approach. For some organizations, however, putting data in the cloud remains a non-starter.

SAP Sales Cloud as one of the primary applications that SAP is relying in to makes a transition to the cloud relies on a similar SaaS-based approach.

While both Salesforce and SAP Sales Cloud are delivered as a SaaS application, organizations will find that there is a significant gap between merely activating a software license and being able to effectively employ Salesforce to manage a sales process. That work often requires either hiring someone with a lot of Salesforce expertise or relying on a third-party service provider.

Customization

Salesforce provides a rich set of options for customizing its CRM application, most notably in a series of low-code Lightning application development tools that are simple enough for end users that have some knowledge of how to construct an application to employ on their own. Most recently, Salesforce has begun to make elements of that low-code platform available as open source code.

SAP allows organizations to customize SAP Sales Cloud to a degree and as far as low-code tools relies on a reseller agreement with Mendix, a provider of a third-party low-code application development platform that is a unit of Siemens.

Integrations

Salesforce provides access to a raft of tools and well-defined application programming interfaces (APIs) to foster integration and has done a lot of work to integrate its core CRM application with, for example, the marketing automation and customer service platforms it provides. In addition, Salesforce last year moved to acquire MuleSoft, a provider of application integration software and services. In addition, Salesforce makes available multiple platform-as-a-service (PaaS) environments

SAP, meanwhile, as part for the SAP C/4 suite of cloud services makes available SAP Hybris Cloud for Customer Element, a separate turnkey cloud service for API integration as well as SAP Cloud, an instance of the open source platform-as-a-service (PaaS) environment developed under the auspices of the Cloud Foundry Foundation.

It also worth noting that SAP Sales Cloud can also be integrated with the Sap Hybrid e-commerce platform that share much of the same code base and that SAP has pledged to lower the cost of integration by making available hundreds of turnkey modules for specific use cases that promise to lower the total cost of integration.

Customer Support

Both SAP and Salesforce provide access to customer support. However, Salesforce has built a massive end user community through which sales administrators and developers provide each other with mutual support and share best practices.

In addition, it’s also worth noting the number of third-party service providers that have built a practice around Salesforce dwarves the number of similar companies that have built a practice around SAP Sales Cloud. There are more than 65,000 Salesforce-accredited consulting professionals. However, SAP is working on growing that base by primarily trying to encourage service providers that sell its ERP offerings to extend their practices to include the SAP C/4 suite of SaaS offerings.

Features & Add-ons

Salesforce makes available more features within its CRM application. Salesforce has a significant edge in terms of the size and scope of the app store it makes available to discover a wide range of add-ons and additional modules, such as marketing automation tools, developed by both Salesforce and its third-party partners. Core the Salesforce strategy is common customer record that it allows all its own add-on software and third-party partner software to invoke via a common object model. Salesforce is in the process of extending that model out to applications it has acquired and third-party vendors may often provide entirely different user interfaces, so the level of integration can be uneven. There are more than 5,000 technology solutions listed on Salesforce AppExchange.

SAP as a long-time provider of packaged application software has hard a harder time determining which providers of external applications are friends versus future foes. SAP efforts to build an ecosystem of third-party partners remains comparatively nascent, but the company has launched its own application marketplace.

Additional CRM Comparison Articles to Consider

How to decide which is Best for Your Situation

Many organizations are going to favor Salesforce if for no other reason than their sales teams have been exposed to it for so long. Training new members of a sales team on how to use Salesforce is usually trivial because many of them will have been exposed to it in previous jobs.

There are, however, many organizations that have decided to standardize on SAP ERP and e-commerce applications. Those same organizations are in the process of transitioning those applications to run on the SAP HANA database. As that transition occurs, many of them may decide to embrace the SAP SaaS portfolio to create a common data model underneath a CRM application that in many ways is the front-end application for driving digital business processes. In fact, SAP is trying to encourage organizations to move past simply focusing on a CRM application in favor of a larger real-time customer experience strategy of which CRM is only one element.

Salesforce, of course, has also embraced a customer experience mantra that revolves around integrating its CRM offering with SaaS applications for marketing and customer service. The decision to go with one CRM application over another might come down to level of faith customers have in the ability of either company to deliver on that promise.

For now, however, if the only factor being considered is the needs of a sales team, then Salesforce still enjoys a significant edge.